TDS is one of the many ways to collect tax from tax payers across the country. Actually TDS reduces one’s taxable income and could even provide tax relief! The TDS collections accounts for 40% of the total taxes collected in the country.

The process of calculating the TDS involves these steps:

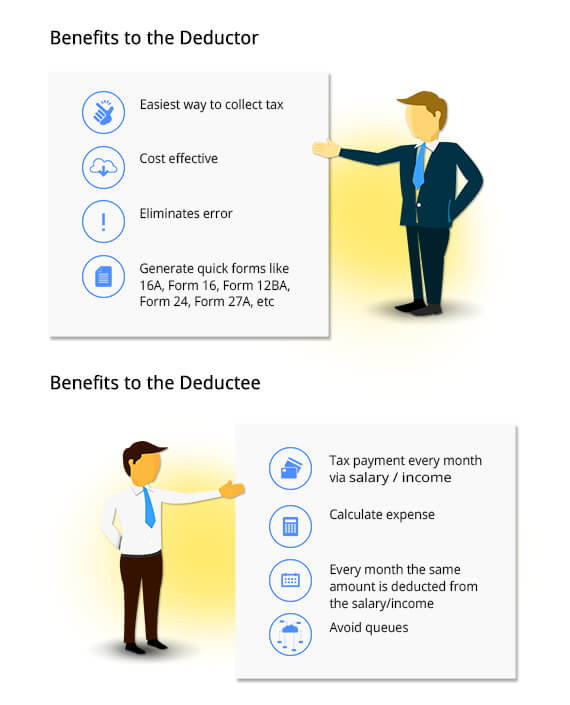

The concept of TDS was introduced with an aim to collect tax from the very source of income. As per this concept, a person (deductor) who is liable to make payment of specified nature to any other person (deductee) shall deduct tax at source and remit the same into the account of the Central Government. The deductee from whose income tax has been deducted at source would be entitled to get credit of the amount so deducted on the basis of Form 26AS or TDS certificate issued by the deductor.

Simple to use

Simple to use

TDS is a simple method of tax collection. The calculation for all the workers can be performed in a simple and fast manner with the assistance of the various tax calculators accessible online.

Problem Free

Problem Free

TDS offers an avenue in which an individual can make tax payments each month, such that an equal sum is deducted all through the year.

Better budgeting

Better budgeting

Each month a standard amount of money is subtracted from the income of an employee in the TDS system. This means the employee is aware of the amount of salary he will get each month.

The simpliest way for e-filing Tax Returns in India